Data Flow and Compliance Status Model

A.ID streamlines compliance data collection, verification, and risk evaluation through a flexible, modular system that adapts to your specific business and regulatory needs. Our architecture ensures that client information flows seamlessly from the first interaction to ongoing risk monitoring, enabling consistent, real-time compliance status updates across your operations.

Client Data Entry

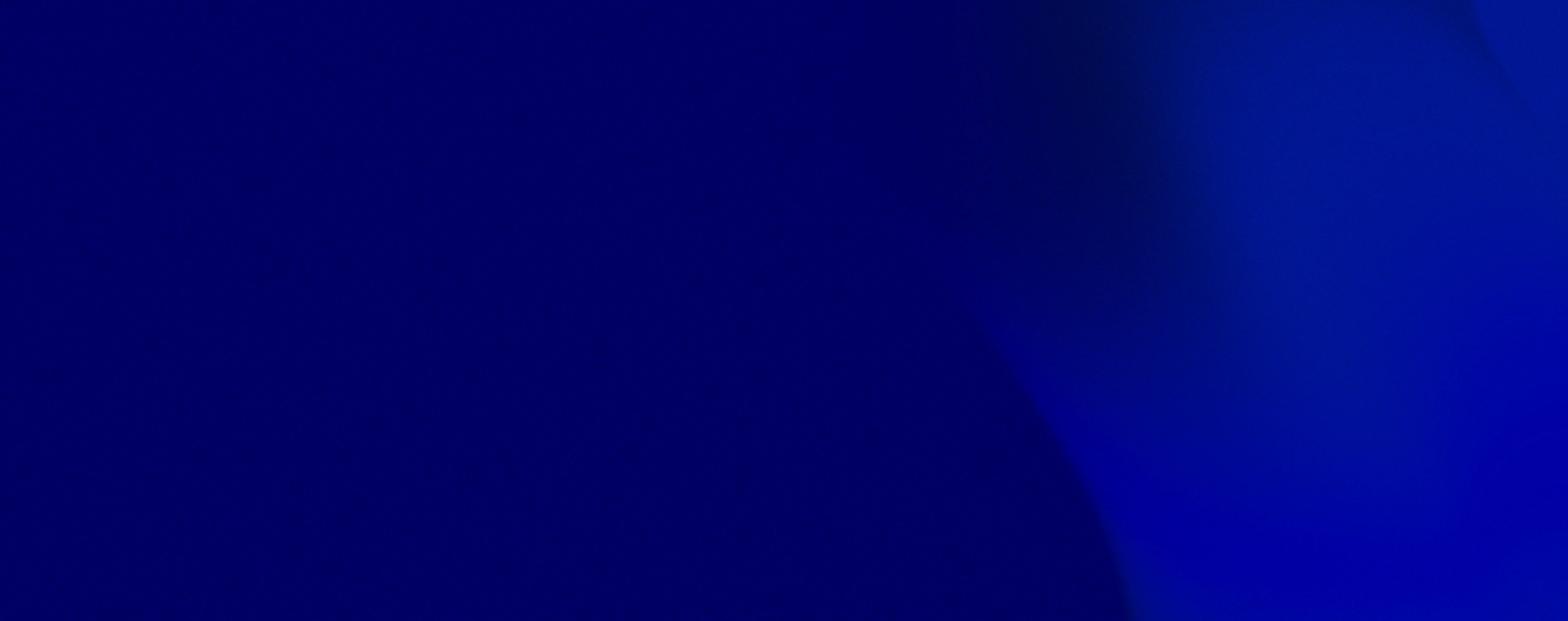

Seamless Onboarding, Fully Configurable

Form Builder

Quickly design and deploy custom onboarding forms without coding. Collect exactly the information you need from your clients, tailored by client type, risk segment, or jurisdiction. Supports dynamic fields, conditional logic, and embedded verification triggers directly within the form structure.

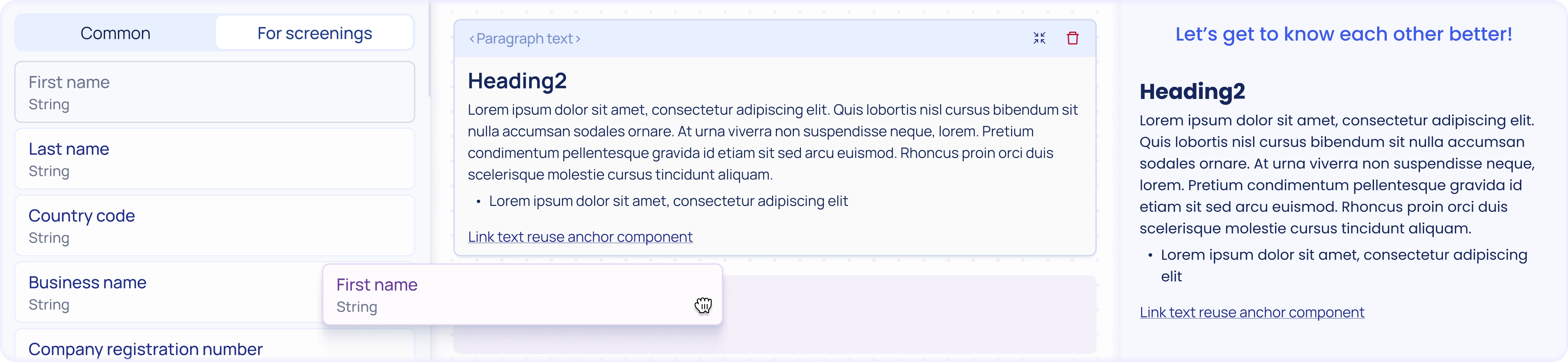

API-first Architecture

Integrate A.ID’s powerful onboarding and compliance engines directly into your own systems. Flexible, well-documented APIs allow you to automate data collection, trigger verifications, and receive structured compliance statuses programmatically.

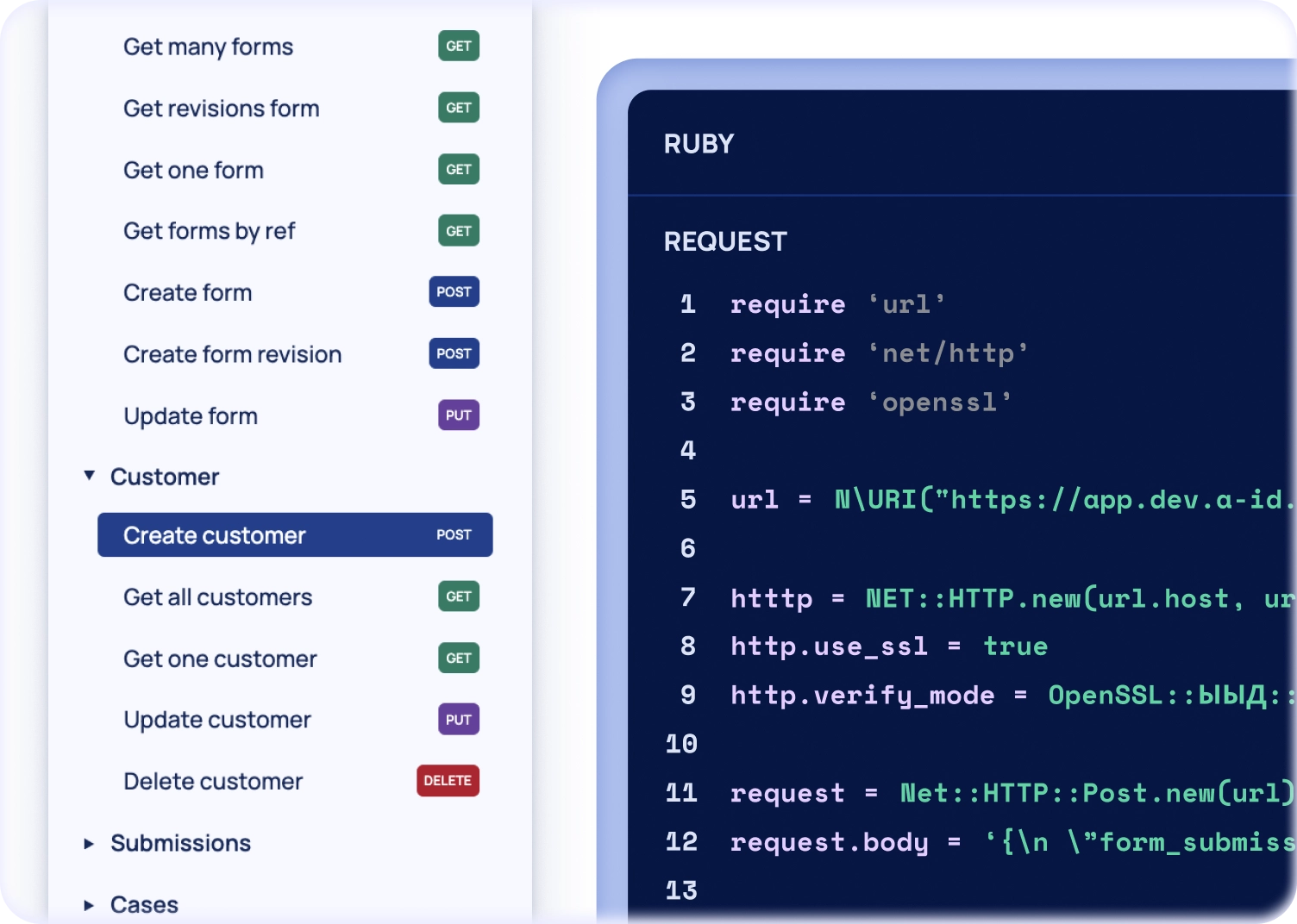

White-labeled Experiences

Create branded, client-facing onboarding experiences that embed trust into every interaction. A.ID enables full white-label customization of forms, and workflows — maintaining your brand identity while leveraging enterprise-grade compliance infrastructure.

Digital Onboarding Flows

Streamline client journeys through fully integrated onboarding pipelines. Сombine ID verification, document collection, sanctions screening, and KYC data gathering into seamless, intuitive flows — branded and ready to deploy.

A.ID simplifies how you collect and structure compliance data from day one. Through branded onboarding flows, flexible form builders, and robust API integration, you can capture exactly what you need — securely, efficiently, and in your own style.

Client data enters the system clean, structured, and ready for verification.

External Data Verifications

Automated, Always-on Trust

A.ID enriches your compliance workflows with real-time intelligence from trusted external sources. Integrated verifications run automatically in the background — enhancing client profiles with sanctions data, corporate records, crypto risk signals, and more.Everything is structured, linked, and ready for action — no extra steps required.

01

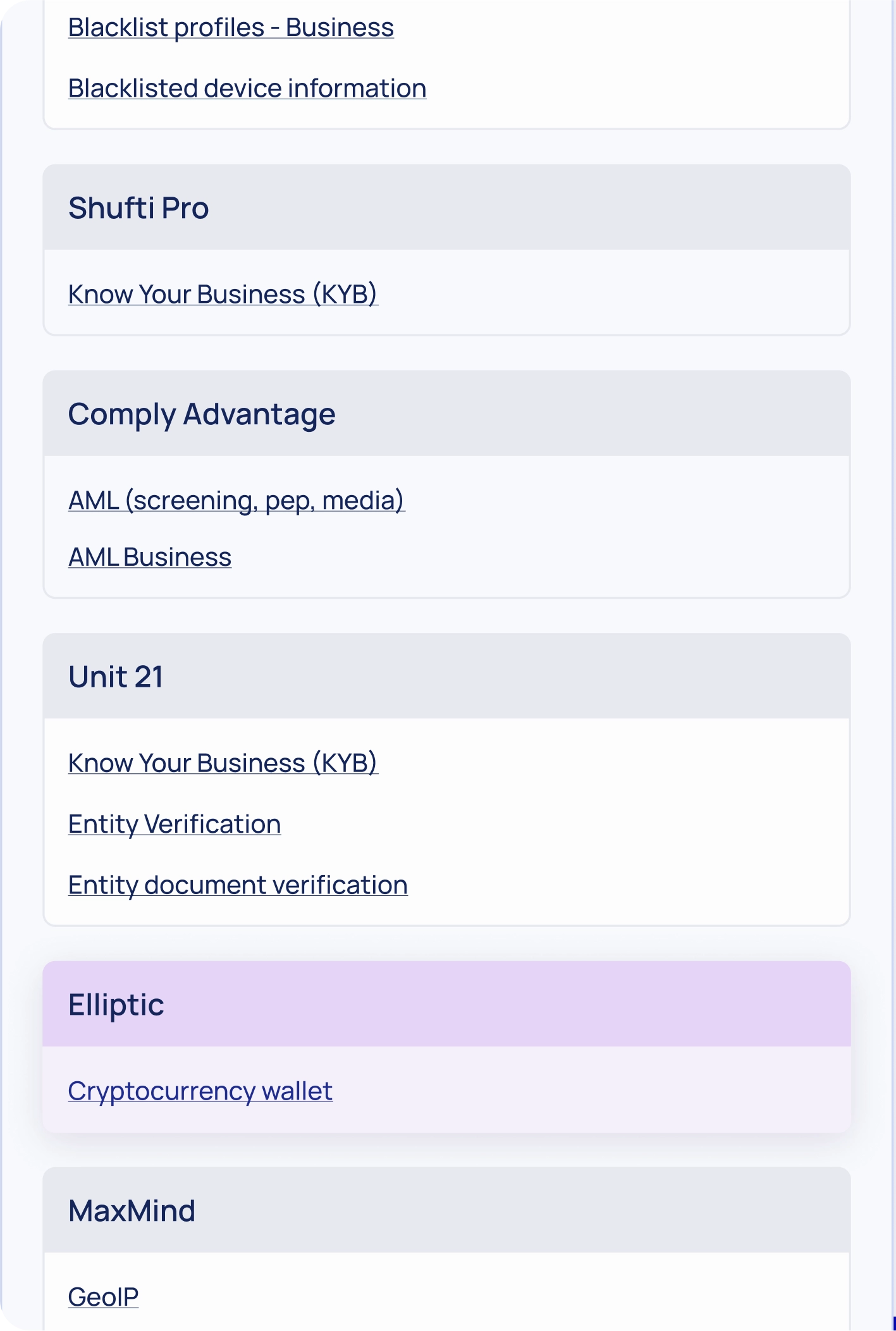

Data Source Integrations

Extend your due diligence coverage instantly with plug-and-play access to global data providers, including ComplyAdvantage, Unit21, MaxMind, iDenfy, Veriff, Elliptic, and others. Run sanctions checks, PEP screenings, corporate registry lookups, crypto wallet risk assessments, and more — all automatically linked to profiles.

02

Manual Provider Selection

Compliance officers can manually select the appropriate external data sources and screening types based on the client’s profile, risk level, and jurisdiction. A.ID supports flexible provider configurations — allowing teams to stay in control of costs, verification depth, and regulatory relevance.

Automated Risk Assessment

Dynamic Risk Evaluation for Every Client Profile

As data flows in, A.ID continuously evaluates client risk in real time. Each verification result, document, and activity feeds into dynamic scoring models that update a client’s risk profile automatically. This ensures your compliance status is always current — and your team always ahead of emerging risks.

Automated Risk Scoring

Based on rules, risk models, and configurable thresholds

Entity-type Awareness

Tailored logic for individuals, corporates, crypto wallets, and beyond

Risk Timeline & History

Full transparency into changes, triggers, and case escalations

A.ID Europe UAB | Savanoriu avenue 6, Vilnius, LT-03116, Lithuania

© 2026 A.ID Europe UAB. All rights reserved