Transaction Monitoring

Monitor, analyze, and act on financial activity — in real time. A.ID’s transaction monitoring module empowers your compliance team with a fully integrated, rule-driven system that detects risk before it becomes exposure.

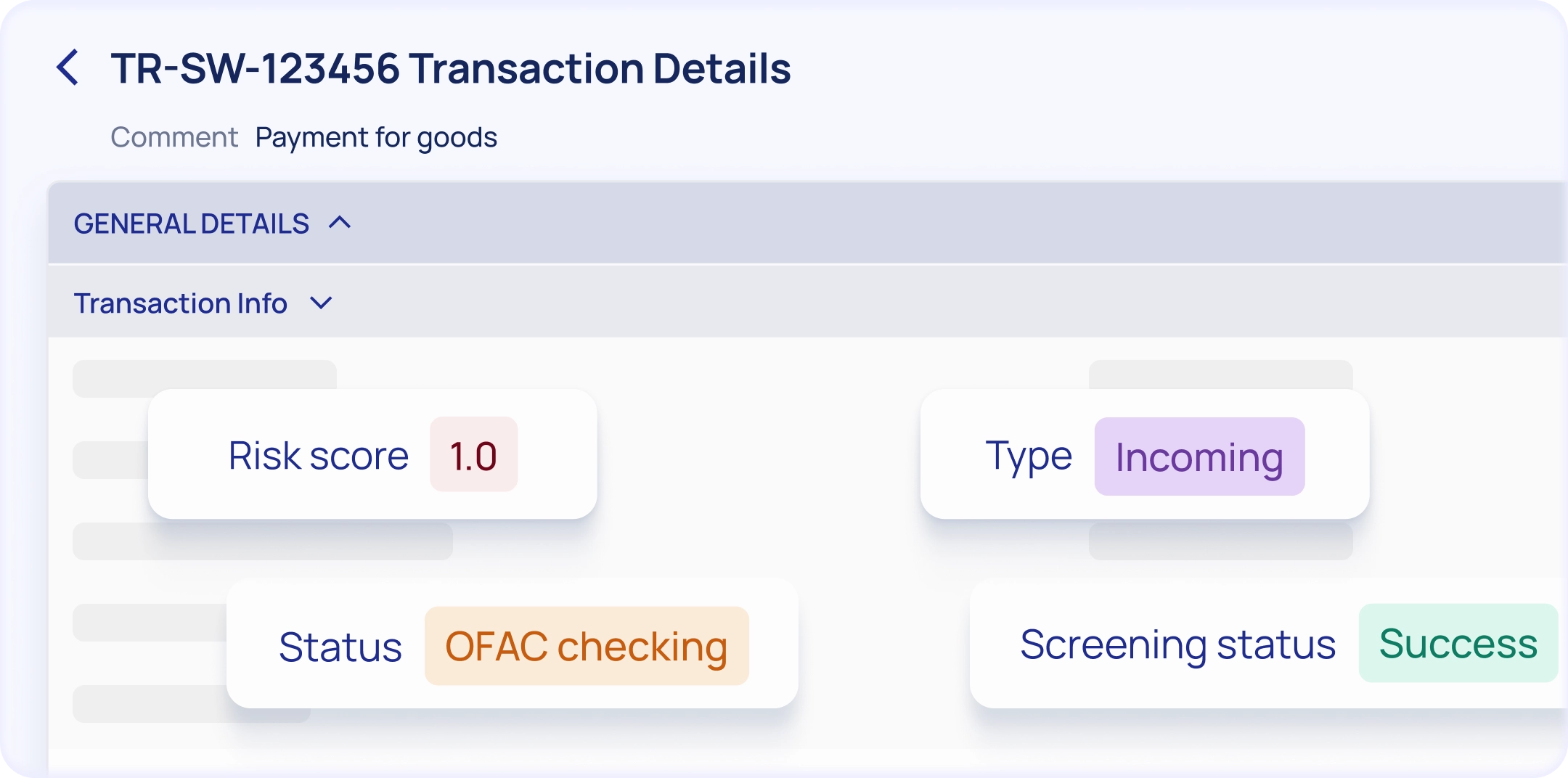

Real Time Transaction Monitoring

Scalable, Instant, Intelligent

A.ID’s real-time transaction monitoring engine gives compliance teams the power to detect and respond to suspicious activity the moment it occurs.By continuously analyzing transactions as they happen, A.ID enables proactive mitigation, faster escalation, and stronger control over financial exposure. Our system supports both instant alerts for high-priority red flags and configurable rule logic for more complex behavioral patterns — across fiat, crypto, and hybrid transaction flows.

Direct Case Creation

Automatically escalate high-risk transactions into case workflows for investigation and documentation.

Live Anomaly Detection

Instantly identify transactions that breach predefined rules, thresholds, or behavioral patterns.

Unified Transaction Visibility

Monitor flows across business systems and payment processors through a single, structured interface.

Designed for Scale

Built to support high-volume financial environments without latency or data loss.

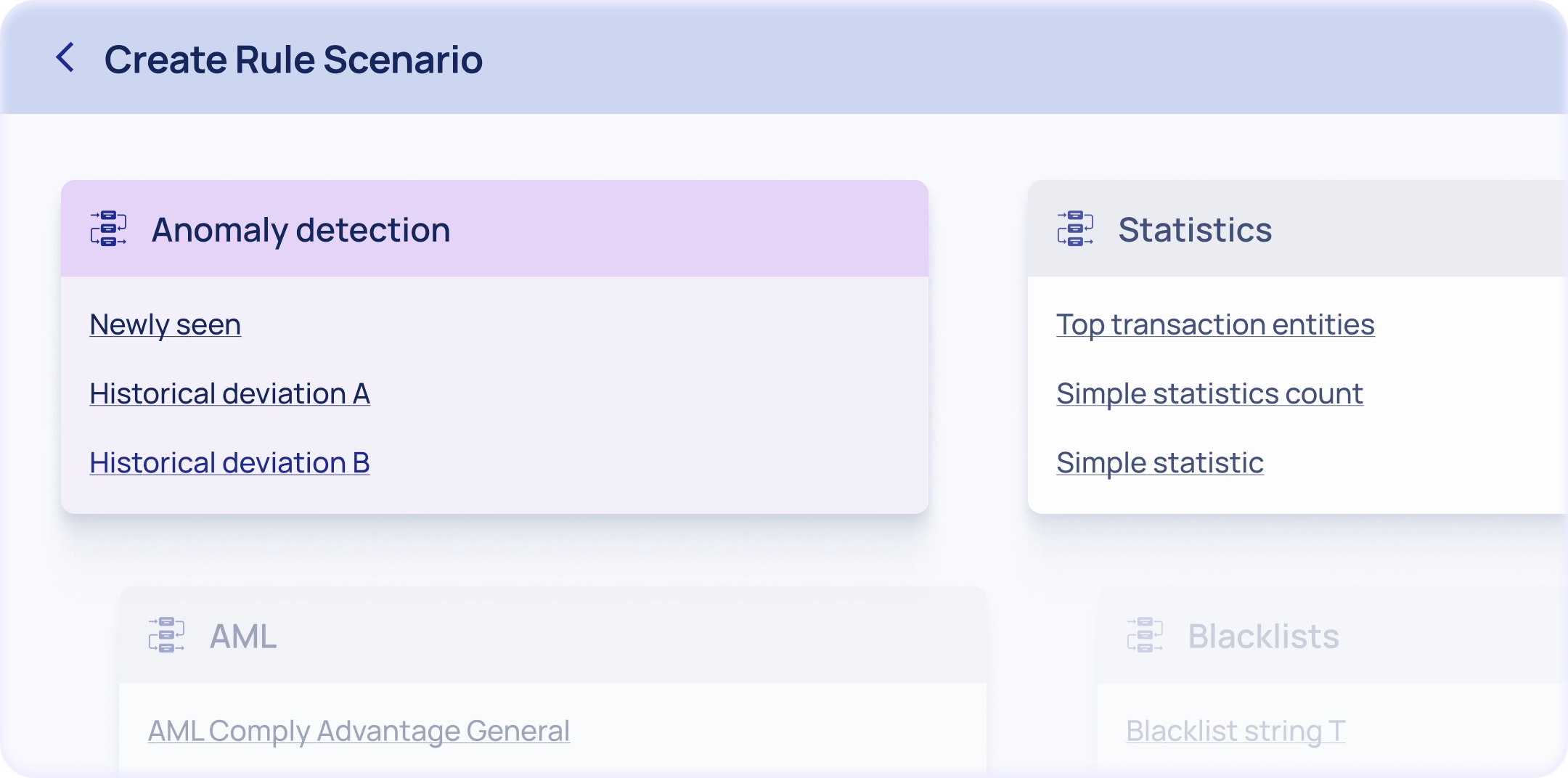

Rule Engine

Flexible Logic, Powerful Detection

Rule Engine enables compliance teams to define and manage transaction monitoring rules tailored to their risk strategy — no coding required. Rules automatically detect suspicious patterns and trigger alerts, ensuring real-time oversight and consistent enforcement.

01

Custom Rule Creation

Get started with templates tailored to common risk scenarios

02

Pre-built Rule Sets

Get started with templates tailored to common risk scenarios

03

Time-based Logic

Define rules that trigger based on activity over time windows

04

Continuous Optimization

Adjust logic on the fly as threats evolve

Automated Risk Assessment

Dynamic Risk Evaluation for Every Client Profile

As data flows in, A.ID continuously evaluates client risk in real time. Each verification result, document, and activity feeds into dynamic scoring models that update a client’s risk profile automatically. This ensures your compliance status is always current — and your team always ahead of emerging risks.

Real-time Screening Checks

Run PEP, sanctions, and adverse media checks on counterparties or senders

Trigger-based Escalation

Escalate cases based on combined TM + screening risk

Unified Case Generation

Automatically open compliance cases with relevant data and risk context included

A.ID Europe UAB | Savanoriu avenue 6, Vilnius, LT-03116, Lithuania

© 2026 A.ID Europe UAB. All rights reserved